Public Dissentiment

Algorithmic protest tool

Public Dissentiment was an online tool that helps protesters negatively impact the price of a publicly traded stock by using the same sentiment analysis tools used by stock trading algorithms.

In the contemporary stock markets, high frequency trading bots that continuously buy and sell stocks perform the role of market makers. These bots provide the market with liquidity by usually being ready to take the buy or sell end of a stock trade. However, these algorithms are also reading news stories and social media posts at lightning speed, and when they detect uncertainty they will pull out of the market causing a stock, or group of stocks, to drop rapidly in value. Public Dissentiment helps protestors generate social media posts about targeted companies that financial sentiment analysis algorithms will believe to be exceptionally bad. When the app is used by a large group or swarm, the price of the company’s stock will temporarily drop, allowing the protestors to make the shareholders aware of the public’s negative sentiment towards their company. Public Dissentiment was the practice-based component to my dissertation.

Public Dissentiment falls into the category of mass action hacktivism, which is closely associated with tactical media and culture jamming, and typically includes a performative element. The application is a prototype for how protestors can leverage technology in the age of networks.

Public Dissentiment included extensive research into technical and legal aspects of the contemporary networked stock exchange system as well as the history of tactical media and hacktivism. A summary of this research can be found in: “Public Dissentiment: Hacktivism in the Age of High-Frequency Traders” published in the Visual Resources special issue, Art in the Age of Financial Crisis.

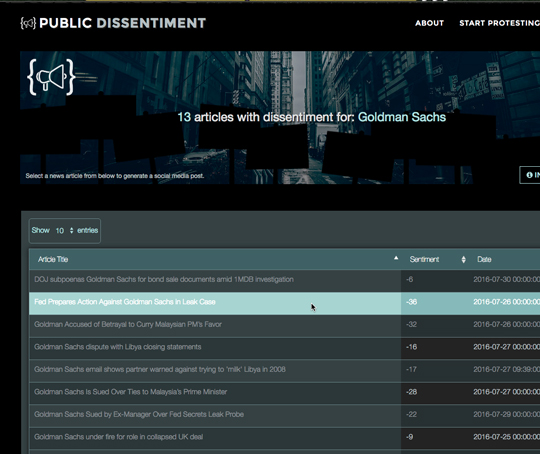

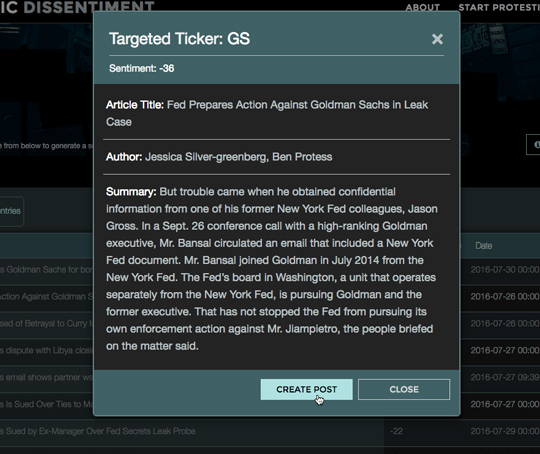

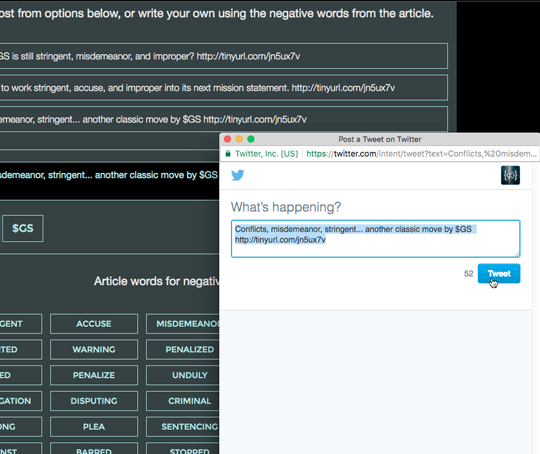

The posts generated by Public Dissentiment were based on actual news stories and would include a link to those stories so that if a trading bot was also web-crawling links, the information would be verified. Public Dissentiment would store a database of news stories with strong negative sentiment for companies known for their negative impact on the environment, poor human rights record, or other forms of misbehavior. If a company was not already included in Public Dissentiment’s database, users could request to have it added. The app would continuously collect new news stories and perform sentiment analysis using a lexicon-based approach based on the Loughran-McDonald financial dictionary. Users could choose which story their post would be based on, and sort the stories according to their negative sentiment. Public Dissentiment would present the user with three algorithmically generated posts that they can modify or customize before posting. The interface provided buttons for all of the negative words found in the story, so that the user could easily include them into their post, along with a button to insert a hashtag (or cashtag in the case of Twitter) with the company’s stock ticker so that it is more easily identifiable by stock traders and bots. A cashtag is a $ followed by the stock ticker for a company indicating to financial professionals and stock trading algorithms that the post contains financial information. There were also buttons for inserting a TinyURL linking to the story with negative sentiment.

Publications & plenary session:

- Derek Curry, “Public Dissentiment: Hacktivism in the Age of High-Frequency Traders.” Visual Resources 34, no. 1-2 (April 2018): 93-115.

- Art Machines: ISCMA – Machine Learning and Art Plenary Panel 4

- Stéphanie Bertrand. Contemporary Curating, Artistic Reference and Public Reception: Reconsidering Inclusion, Transparency and Mediation in Exhibition Making Practice. United Kingdom: Taylor & Francis, 2021.

- Carrie Ida Edinger. "The human experience of Crooked Data." Media-N, vol. 14, issue 1 (2018).

- Armin Beverungen. "Algorithmic trading, artificial intelligence and the politics of cognition." in The democratization of artificial intelligence: Net politics in the era of learning algorithms. Sudmann, Andreas,ed. Transcript, Bielefeld (2019).