Bankster Games

Video Games About Mortgage Fraud

Bankster Games

Bankster Games was a collaborative group founded in the wake of the financial crisis that created digital and analog games designed to explain aspects of financialization that may be difficult for people outside of finance to understand. Many of the games focused on specific stories that emerged from the financial crisis, while others are intended to provide a more general understanding of a particular aspect of finance. All of the games were free or were sold at cost. Financial support for Bankster Games received some financial support from the Puffin Foundation. Notable games included Designed to Fail and Attack of the Zombie Banks

Attack of the Zombie Banks

Attack of the Zombie Banks is a mod of the popular tower defense game Plants vs Zombies, only players must defend themselves against foreclosure by the Zombie Banks. (Zombie banks are banks that have already died, but were resurrected by a government bailout). The levels and characters in the game are based on specific news stories about the financial crisis. The game has three difference acts: The Setup, Wrongful Foreclosure, and Securitization, which teach players about different aspects of the financial crisis. In The Setup, players defend their home from Alan Greenspan’s Zombie, which advocated for easy mortgages and artificially low interest rates, and the Creepy Balloon Mortgage Clown who will sell you a mortgage that may balloon out of control. In Wrongful Foreclosure, players must fend off robosigners who were hired to sign tens of thousands of foreclosure affidavits and Rocket Docket Judges who came out of retirement to preside over no-document foreclosure hearings. Securitization is about how mortgages were packaged and sold to unsuspecting investors.

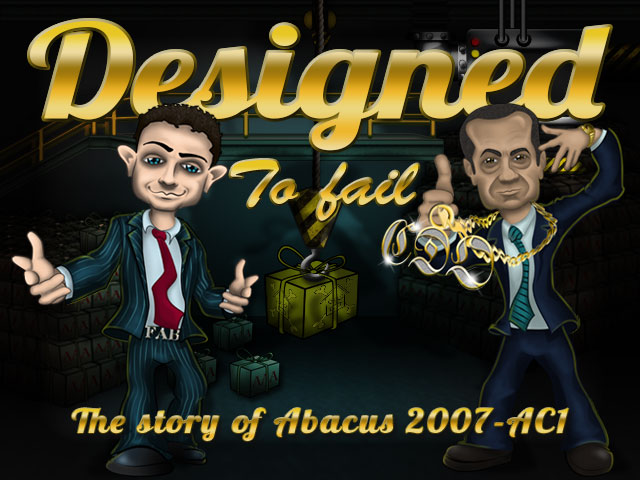

Designed to Fail

Designed To Fail is a game that tells the the story of a Collateralized Debt Obligation (CDO) named Abacus 2007-AC1. In the game, you learn how regular and synthetic CDOs are made and how hedge fund manager John Paulson and former Goldman Sachs Vice President Fabrice "The Fabulous Fab" Tourre made a CDO 'designed to fail.' Paulson bet against the CDO while Goldman sold it to investors. Paulson made roughly $1 billion when the security collapsed, the largest amount made from any single trade in history. The characters in the game are all taken from the United States Senate Permanent Subcommittee on Investigations report "Wall Street and the Financial Crisis: Anatomy of a Financial Collapse is a report on the 2007–2008 financial crisis." For example, Fabrice Tourre has the distinction of being the only executive to have been found guilty of fraud in the aftermath of the 2008 financial meltdown, although he served no jailtime as this was a civil suit and not a criminal case.